Food price inflation and its impact

Food price inflation and its impact

Within the food industry early indications of the rising cost of raw materials and ingredients were present at the start of 2021. These increases took their time to steadily work their way through the supply chain and manifesting higher prices of food on retailer shelves.

Rather interestingly (but perhaps unsurprisingly) although it was clear that price increases were rapidly approaching, these were ignored by politicians and the media for as long as possible (until around September 2021), with recognition only made once explicitly obvious and only then accompanied by two direct or indirect messages:

- That the inflation will be transient or temporary in nature.

- That this has nothing to do with money printing or money supply.

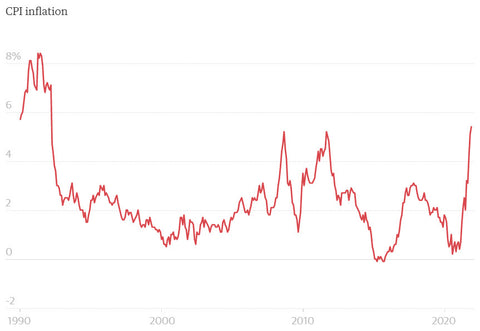

SOURCE: ONS

With inflation as of April 2022 declared at 9% (CPI) and the highest level for decades, there are key questions that should be asked.

- Why has inflation risen?

- Is inflation here to stay?

- What does this inflation mean for households?

- Can I do anything to reduce my exposure to inflation?

So, why has inflation risen?

There are a number of different factors that influence price inflation, however the are two major schools of thought regarding why it arises.

- Monetarist theory regards inflation as essentially a monetary phenomenon. Monetary factors are in their essence interest rates and money supply.

- Keynesian theory - regards inflation as a result of supply and demand issues.

What is clear within the mainstream news is that monetarist theories on inflation are not given significant weighting, instead Keynesian theories are seen as the only significant influencing factors.

For example a recent article in the Guardian on the causes of inflation includes supply chain shortages, staff shortages, hold-ups at UK ports, Brexit and increases in demand. However, notably, no reference is made to monetary causes (such as very low interest rates and huge increases in money supply). Even if you appreciate that price inflation has many different causes it is intriguing as to why there would be no reference to money supply, which is the fundamental root cause.

This appears to be perspective that is closer to Modern Monetary Theory (MMT), which has previously been considered a high risk concept, which if tested in the UK could be disastrous - causing decades of high inflation and economic woe.

Another interesting addition to the narrative occurred in March 2022, when almost immediately following Russia's invasion of the Ukraine on 24th February, this invasion was being blamed for the high levels of inflation - regardless of the fact that inflation takes months to work its way through the supply chain. From a political perspective it makes good sense as to why external factors out of your control are an attractive option for side-stepping blame, but it is surprising to see how the mainstream media appeared to allow this narrative to move to centre-stage.

Is inflation here to stay?

This question is extremely difficult to answer - our best guess is that it will remain high for at least 3 years, however there are so many uncertainties currently (for example, future interest rates, recessions, stock market crashes, crypto crashes, political disputes, war, political interference, monetary stimulus, tax breaks, oil and energy price fluctuations) with many different factors having the potential to contribute to inflation or even deflation, that one thing it would be wise to expect is volatility. This makes it difficult for investors to make strategic decisions, and indeed challenging for householders to take sensible precautionary actions.

What is known is that inflation is going to be part of the conversation for many years - current inflation levels can be seen as a shot across the bow, reminding experts and commentators that low inflation is not guaranteed and that for every action there is a reaction.

From a food perspective, we have been privileged in the UK to have relatively low food prices - the cost of food in proportion to average household income is lower than in many other countries around the world. This, tied in with the reliability and easy access to food (regardless of seasonality) has allowed consumers to feel relaxed when it comes to being able to feed themselves and their families.

Significant food price inflation has the potential to start rocking the boat - testing peoples assumptions and creating new anxieties. When combined with complex food supply chain issues and potential shortages, the threat increases further, and at a certain point it is wise for consumers to change the way they act in relation to food.

Only approximately 50% of UK households food requirements are produced in the UK, meaning that we are significantly reliant on imports from abroad. These imports can be impacted by trade restrictions, freight and transport challenges, border issues, legislative red-tape and political problems such as international relationship breakdowns and war.

What does this mean for households?

What this might mean for different individuals could be extremely varied. A certain proportion will not really be able to make significant changes, typically due to economic constraints. Others might be able to take precautionary actions, reducing the impact on their household.

For many households at the lower end of the income scale, including more vulnerable members of society, there will be an inability to cope with the rising costs of food, resulting in reliance on foodbanks and other more desperate ways to survive. This will likely place more pressure on government to step in and provide more financial support for these individuals, but this might be slow to implement and leave many in a dire situation.

Can I do anything to reduce my exposure to food price inflation?

- Increase your income to at least match the current inflation rate - this can be achieved through salary increases, alternative occupations, 2nd jobs, longer hours or side-gigs (for example).

- Change your purchasing habits to reduce your overall household expenditure and ensure you are able to continue to afford all food necessities.

- Shop smarter regarding food selection to reduce your monthly food expenditure.

- Increase the proportion of food you grow at home to reduce your food expenditure.

- Increase your advance purchases of long-life foods (such as canned, freeze-dried meals or frozen foods) whilst prices are lower.

Suggested Articles

Pandemic Implications

The sustained Covid-19 pandemic, described by some as a ‘black swan event’ has impacted the world in a huge number of...

Homegrown Wisdom: The Surprising Connection Between Self-Sufficiency and Ambient Food Storage

In a world where convenience and immediate gratification reign supreme, it's easy to take our readily available food ...

How might Climate Change harm our our society?

The potential impact of climate change is one that has gained increasing attention and urgency in recent years - in f...